Porinju Veliyath 19th April 2023

Dear Investors,

Hope all of you are keeping well.

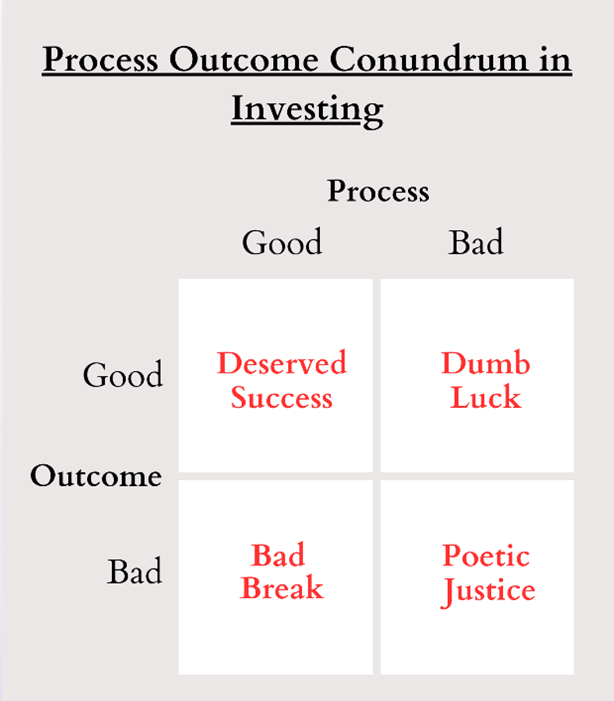

Process Outcome Conundrum in Investing

Equity investing at times can be very easy or extremely difficult. One could end up buying something by just overhearing a friend and making quick easy money and at times one could go quite deep and uncover insights and understanding of the business and do all the right things but still not make good returns. In a complex environment like stock markets, it is common to have bad processes getting good outcomes and good processes at times facing bad outcomes. This is especially true in short to medium terms. Also, despite following a good process, accidents and competition are the reality of capitalism-based system and companies fail to live up to expectations of even a sound judgement. Businessmen and Investors both have no special crystal gazing ball to see future, but both use pragmatic frameworks and processes to operate well today. Future happens to all of us; it just shapes up better over long period to a prepared and process driven mind.

A batsman in a cricket game follows the process of sound technique to bat - which could be a mix of stance, balance, head position, defending and attacking technique, knowing the field etc. Despite all the practice and belief in the process some of the best batsmen go through “bad breaks”. However, a good batsman sticks to the process despite current form and invariably “deserved success” follows. In most crafts, it boils down to the same mantra – “Follow the Process and do not let outcomes play on your mind” – an enduring lesson from the Bhagwat Gita.

We practice value investing. There are several tactics and strategies that could claim to follow the value investing school. Nothing is good or bad. Nothing works all the time. All tactics and strategy could go through “bad breaks”. What matters is how persistent the fund manager is in sticking to the chosen strategy; “Deserved Success” is bound to come in the long term.

If we keep doing our work of assessment of “business value” and built-in “margin of safety” while buying a business; outcome not on one trade but outcome on aggregate of all the trades over long period would be fruitful. This is how investing works. Assessment of business value is the crux of a sound process and entails quite a lot of diligence and continuous updating of the underlying economics of the business.

And as we acknowledge the importance of the “process”; the diligence and hard work of our investment team need to be celebrated. In this letter we share samples of how our investment team works and how this keeps us informed about our holdings.

At times the research process takes us to the ground zero – plants.

Anoop Nambiath visited Hindware Bibinagar Sanitaryware Plant and Truflo Isnapur Pipes plant a few weeks ago. And he came quite satisfied with the quality of manufacturing across products of the company and also accumulated several “differentiated insights” which helped us form even better understanding of the business. Here are just a few of his sample findings:

- Hindware brand as a cornerstone of Quality – comes from the fact that the company operates its manufacturing process with zero compromise. Overall material rejection rate of 0%, and WA (water absorption) factor of 0.2 for every single piece. Local competition compromise on quality as they heat kilns upto 900 degrees vs 1160 degrees by Hindware. Competition does this to save power cost but end up supplying products with life of 6 to 7 years. On the other hand, Hindware products have a good life of 20 years. This, in long term, helps build trust in trade channels and build “Brand” among customers. It is fascinating how few percentages of temperature can be the difference between market leader and an also-run company.

- Truflo is the fastest growing Plastic Pipe brand in India. Plant has enough free hold land to expand further. Besides they are likely to set up more plants in North, West and East in that order.

- Anoop also spent quality time interacting with a key team member who has been entrusted by board to set up plant from scratch and scale the pipes business. Mandate is very clear to be in the league of current market leaders like Astral and Ashirwad.

- They have set up the best-in-class plant, fully automated from raw material to loading of finished goods. They have installed top quality extrusion machinery from Germany and injection moulding machines of a leading vendor.

- Pipes business has two classes of customers – plumbers and plumbing consultants. Company is very clear about their go to market strategy to become a significant player.

- Stringent than required quality checks – products are of far higher quality than peers.

- Overall, they look well set to grow at 1.5-2x than industry in pipes for the near future.

- Ground reports indicate that Truflo in coming decade can scale up significantly and with HHIL’s current market capitalisation of Rs 2700 crores we see huge head room of wealth creation. Just note that Astral is close to Rs 38,000 crores market capitalisation company with revenues of roughly Rs 5000 crores.

- Few pics from Anoop on his research day – messy process but helped us to conclude that Hindware Home Innovation is a quality business with highly scalable opportunities and company is doing all the right things on ground to grow. Market capitalisation should grow too over time.

And on some other occasions research process compels us to quiz the promoter.

Ramakrishnan V. met top management and promoter of Raymond in Mumbai in February and came satisfied with the progress and promise about future we envisage as we own the company.

- Raymond is an extremely strong brand which has not lived up to its full potential as a business. However, management has in the recent past taken several initiatives across various facets of the business including – strategic, cost rationalization, new growth initiatives, restructuring the operations etc.

- This has resulted in cost savings of close to Rs 400 crores and which are likely to sustain.

- Net working capital has come down to 55 days from 98 days indicating much better cash conversion and cash flows. This has meant debt has reduced to around Rs 900 crores from Rs 2300 crores a few years back.

- They are now quickly plugging some immensely high growth and profitable business of Ethnic and casual ethnic which they failed to cater before.

- They continue to rationalize, improve profitability, and grow across all verticals - textiles, garments, FMCG, Engineering, Auto components and Real estate.

- One of the key concerns about the management has been the laxity in capital allocation. Management team now comprises of some very credible professionals and are determined to do much better job at capital allocation.

- Ramki got a better understanding of several growth levers unleashed by Raymond which would help them grow at a very healthy 15% to 18% kind of revenue growth with improving margins. This augurs well for the stock even after the last twelve months of healthy performance.

And at times it is sitting in solitude in office debating out news flows around the investment

George John and Reuben Mathews contemplate the current acquisition by Tata Communications of “Switch” in US in light of the ongoing “reimagine strategy” company has been implanting.

- In just three years post newly appointed CEO Amur Lakshminarayanan, a TCS senior and CFO Kabir A. Shakir, a Unilever veteran across European geographies, joined Tata Communications— company has seen a massive turnaround.

- New team is doing all the right things and have been following a very clear and sound “Reimagine Strategy” – which we have taken time to understand and are very bullish about the same.

- Since 2019, two of the big hurdles have been dealt with: The demerger of surplus land held by VSNL to a new entity, and the selling of the South African Neotel unit and a 74 percent stake in its data centre business to a unit of Singapore’s Temasek Holdings. After the land sale, the government, by March 2021 exited Tata Communications completely. Now the management is implementing and focusing on strategy to transform company from sleepy telecom company with focus on voice solutions to a very agile digital platform & solutions provider globally.

- Team set itself to get financial fitness in terms of lower debt, 25% operating margins and 25-30% ROIC as first stage of transformation before peddling for growth. Financial fitness is now well established, and team is now focusing on investing for growth.

- Tata Communications acquired Switch Enterprise, a live production and video transmission company in US for Rs 485 crores. The deal seems very complementary in terms of geographies and product portfolios. The entire deal was funded with internal accruals. Company after achieving financial fitness is now capable of funding such $50 mn to $ 100 mn acquisitions to grow into chosen areas.

- The Switch deal adds to Tata Communications’ production capabilities which it can cross-sell to existing global customers. Switch has production facilities at many locations which will act as an entry barrier; and Tata Communications’ global cloud-based delivery solutions will add value to Switch customers. In Post-acquisition call management indicated that Switch could be margin-dilutive initially but should improve on realisation of synergy benefits accrued in medium term.

- Tata Communications’ next strategy for growth could well focus more on the international market, where it has massive untapped opportunities to increase its revenue pie, compared to other global players. Company deals with several Fortune 400 companies but at much smaller scale. It aims to grow immensely with robust product offerings.

- Tata Communications’ “reimagine strategy” is a work in progress and should result in healthy double-digit growth with extremely lucrative ROCE and operating margins. This is going to be immensely value creating for shareholders over the next few years.

Investment management is all about accumulating actionable insights around value of a business on daily basis with passion and diligence. Non-linear and uncertain nature of the markets and capitalism in general means outcomes don’t show up daily in linear fashion. However, in life and in investing the wise focus on what is in his or her control and leave the outcomes to play out the way they would.

We hope to get a bit wiser daily about “Value” of our portfolio holdings through a diligent process and passion for our craft. “Price” we hope would converge sooner or later.

Thanks

Porinju Veliyath